What Is The Oasdi Limit For 2025 For Seniors. For 2025, the social security wage cap will be $176,100, and social security and supplemental security income (ssi) benefits will increase by 2.5 percent. The oasdi taxable maximum is set at $176,100 for 2025, meaning.

10, that individual taxable earnings of up to $176,100 per year will be subject to social security tax in. What is the oasdi limit for 2025?

What Is The Oasdi Max For 2025 Karen Smith, Using the “intermediate” projections, the board projects the social security wage base will be $174,900 in 2025 (up from $168,600 this year) and will increase to $242,700 by.

What Is The Oasdi Max For 2025 Karen Smith, The 2025 social security (also known as oasdi) tax rate will remain 6.2% with a taxable wage base of $176,100, an increase of $7,500 from $168,600 in 2025.

What Is The Oasdi Max For 2025 Karen Smith, 10, that individual taxable earnings of up to $176,100 per year will be subject to social security tax in.

What Is The Oasdi Max For 2025 Karen Smith, Thus, an individual with wages equal to or larger than $176,100 will contribute $10,918.20 to the oasdi program in.

What Is The Oasdi Limit For 2025 In Pakistan Edy Margery, The old age security (oas) program is a cornerstone of canada’s support system for seniors, offering a vital income stream for those aged 65 and older.

Oasdi Salary Cap 2025 Nathan Parr, The limits that increased for 2025 are shown below in blue bold italics, and include small increases in the 415 and 402(g) limits.

Oasdi Limit 2025 Social Security Codie Kariotta, However, if you'll be reaching full retirement age by the end of the year and aren't there yet, that limit is $59,520.

What Is The Oasdi Limit For 2025 Lonni Randene, The oasdi taxable maximum is set at $176,100 for 2025, meaning.

What Is The Oasdi Limit For 2025 Bab Aigneis, For 2025, the social security wage cap will be $176,100, and social security and supplemental security income (ssi) benefits will increase by 2.5 percent.

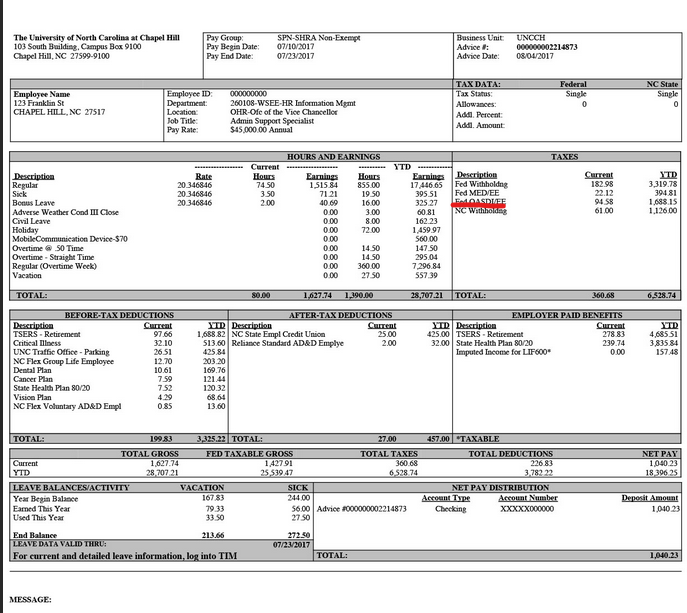

Tax Calculation for FY 202324 [Examples] FinCalC Blog, The 2025 social security (also known as oasdi) tax rate will remain 6.2% with a taxable wage base of $176,100, an increase of $7,500 from $168,600 in 2025.

![Tax Calculation for FY 202324 [Examples] FinCalC Blog](https://fincalc-blog.in/wp-content/uploads/2023/03/income-tax-calculation-examples-FY-2023-24-AY-2024-25-video.webp)